With us now swapping USDC for SOL on Mango Markets, the discussion regarding what precisely to do with the SOL is overdue. The overwhelming majority was in favor to delegate and stake the SOL on a Solana Validator. The only voice against it wasn’t really against it per see, but they asked whether we should not take a portion of the SOL and diversify it through using mSOL.

This thread is intended to explore precisely that: Do we want to deploy our $SOL? If so, how and where?

As always, there is no easy answer, and the topic can best be broken down into subsections, tackling one question at a time. However, it also makes it easier to address everything and to create polls on each main topic afterward.

Here are some topics that we need to address that are often interconnected:

- How much SOL do we want to delegate to a Solana Validator?

- Do we still favor the idea of a Grape-owned Validator (or a partnership)?

– What would be the model/revenue share?- What Validator do we choose?

– Do we want to pick multiple Validators and divide the allocation?

– Do we swap SOL for mSOL?- Do we want the GRAPE community to participate?

– Do we collect the funds from the community and stake together?

– Or does everyone stakes on their own, and we incentivize staking?- What method do we want to use for the deployment of the funds?

- Who monitors our investments?

- When do we start and are there any specific timeframes?

If I missed something, please say so. I’ll edit the post and create the corresponding polls after we had time to discuss everything.

My goal is to write up a pros and cons list with your help so that voting gets a bit easier.

1) How much SOL do we want to delegate?

The initial proposal suggested allocating 3,000 $SOL for the purpose of staking. This, of course, requires us to have the SOL available. At the time of writing, we have a bit more than 300 $SOL (see here), with a total of 100,000 $USDC available for swapping.

Since the 3k $SOL was only a guesstimation and us using 20k $USDC less than the initial proposal enabled us to use, it isn’t easy to estimate how much SOL we end up with.

I think 2,500 $SOL is reasonable and a conservative estimation given the current market conditions. That said, it obviously isn’t a guarantee but a good starting point for our considerations.

Do we want to use all of the ~2,500 $SOL? Should we swap more USDC to SOL, or would the 2,500 even be too much for staking?

2) Do we still favor the idea of a Grape-owned validator (or a partnership)?

The most prominent post regarding this question would undoubtedly be Hanko’s proposal of Soladex Joins Grape. But, while having talked about this topic a lot, we never came to a decent conclusion on how to proceed. I remember Soladex being in a bit of a tight spot due to Solana issues and, as a result, unfortunately, losing quite a bit of active stake (see here).

But at the same time, Hanko announced that he invested in new server infrastructure for a more reliable performance.

Another topic was an inquiry with the Solana Foundation regarding their Delegation Program, so that Soladex could get the 25,000 $SOL directly from the Solana Foundation. Maybe Hanko wants to update us on this.

– Partnerships –

There was also an idea to look for other potential partnerships in case we decided against having a 100% Grape-owned Validator and the thereby mitigate some of the potential risks involved. One suggestion was the validator of the Shadowy Super Coder DAO.

– Modalities –

If we decide to either pursue running a Grape-owned Validator or find a suitable partner, we need to think about how we want to structure everything. We could, e.g., give the community the chance to participate and get a share of the revenue (if any).

A potential partnership could also be done in many different ways. We could e.g. pledge a certain amount of SOL for a set amount of time and in return receive a share of the revenue plus the validator name gets changed (Soladex feat. Grape or Grape Soladex) Terrible names, I know, but you get the gist. For better ideas, please contact the ![]() thx.

thx.

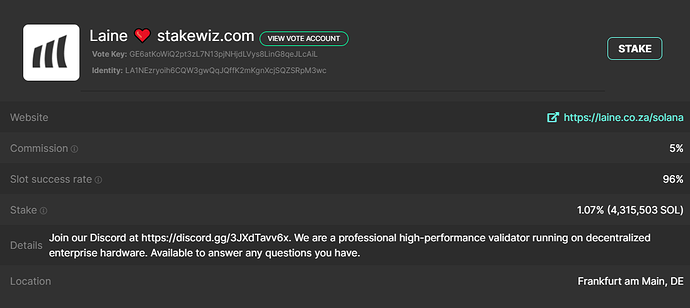

3) What Validator do we choose?

Regardless of whether we opt for a Grape-owned Validator or a partnership, or non of that, we need to decide what Validator we want to choose. (I hope we all agree, that we don’t want to actually run our own validator.)

There are - of course - several different ways to approach this and we can use different criteria based on our goals and what we intend to communicate with our actions. What are our metrics:

– Do we choose a popular/important project that runs its own Validator?

– Do we go by APY/reliability?

– Do we want to support a specific project?

Solana Beach and Solana Compass for reference.

– Multiple Validators? –

Another question that needs an answer would be whether we want to choose 1, 2, or more Validators for staking. While our impact with each Validator we support would diminish with the next one, it could be a prudent choice if we consider risk. Although we can’t lose our SOL (as long as there is no slashing), we could lose out on revenue in case the Validator becomes delinquent over a longer period of time (hours, not days). Delinquent Validators usually get filtered out, and you can’t stake with them any longer. This also leads to validators losing staked SOL which in turn has an impact on revenue.

– mSOL –

There is also always the possibility to stake through Marinade by converting our SOL to mSOL (what is that?). This also could be done via Realms, so everything stays directly on-chain.

4) Do we want the GRAPE community to participate?

This question needs a bit of an explanation since participation can mean a lot of things.

– Community staking –

One way for the Grape community to participate could be via direct participation in the staking pool. This could - potentially - drastically increase the amount of SOL Grape has to offer for, e.g., a potential partner. The downside could be the potential organization nightmare to manage the funds the community members want to stake. The requirement to stake at least for a fixed amount of time could solve that.

While the operational tasks for Grape could easily be fixed that way, a downside for the members who are willing to stake would be the inherent risk of handing over their SOL with potentially no direct upside compared to them staking on their own.

– Self-staking –

Another way for us to increase the SOL stake Grape delegates could be to direct the flow of funds that get staked by the community. Either by suggesting and incentivizing staking on a specific validator and granting rewards for (in GRAPE) for doing it. Or by creating our own staking contract on our Dashboard.

5) What method do we want to use for the deployment of the funds?

I think we all agree that doing things on-chain is an important step in our efforts towards true decentralization. At the same time, it is always important to weigh the risks involved. If we use Realms, e.g., we need to be aware that our flexibility would be reduced. This might be countered somewhat by creating a new treasury wallet with a different/reduced voting period for when we want to make changes to the stake. This again comes with other risks.

Therefore, it’s important to find the best method to deploy/manage the funds and we need to be aware of the specific inherent risks.

6) Who monitors our investments?

While theoretically being a set and forget operation, our validator endeavor could represent a sizable amount of our treasury (~1/5 in USDC and potentially more once SOL go up). Therefore, depending on the manner we allocate our SOL, it could be necessary to monitor the funds.

7) Start WEN?

Last but not least remains the question of when. When should we start? Once we have the full amount that we want to stake? Do we stake in increments? Should we stake for a specific duration or until a new proposal wins that suggests otherwise?

END

Many questions and things to think about, I know. Glad you made it that far though ![]()

Now grab something to drink. Go for a walk and get some fresh air, whatever. Then come back and write a reply to whatever is on your mind. All input helps. The next step will be individual polls below this post. See you on the DAO Call!

Cheers,

Pawz